How Long After You Pay Off Debt Does Your Credit Improve?

The daily financial decisions you make can either help or harm your credit. For example, when you pay your loan or credit card bills on time, you establish a positive repayment history that will build your credit. On the other hand, making late payments or carrying large credit card balances can damage your credit.

Paying off debt accounts is a huge accomplishment that can also impact your credit, but how long does it take to have an effect? The answer depends on the type of debt in question, the specifics of your credit portfolio and when the creditor reports the account’s status to the credit bureaus.

There’s no guarantee that paying off debt will help your scores, and doing so can actually cause scores to dip temporarily at first. In general, however, you could see an improvement in your credit as soon as one or two months after you pay off the debt. Here’s what to expect as you pay off debt.

Revolving Accounts (Credit Cards)

A credit card is a form of revolving credit, meaning money can be re-borrowed as it’s paid back, and there’s no end term. When you have an active revolving credit account, your balance plays a major role in your credit utilization ratio, which influences as much as 30% of your FICO ® Score Θ .

Your credit utilization ratio measures how much of your available credit you’re using at any given time. For example, if you have one credit card that has a balance of $1,000 and a credit limit of $2,000, your credit utilization rate is 50%. Credit scoring models look at how much of your available credit you’re using both on individual cards and in total across all of your accounts.

There’s no magic number to aim for, but generally a credit utilization above 30% can drag down your credit score. Keeping your utilization below that rate can help you improve your credit. Those with the highest credit scores tend to have credit utilization rates in the low single digits, according to Experian data.

When you pay off a credit card balance and keep the account open, you’re doing yourself a huge favor as far as your credit is concerned because you’ve reduced the amount of available credit you’re using. This boost from paying off an account can be seen on your credit report quickly; lenders usually report account activity at the end of the billing cycle, so it could take 30 to 45 days for it to impact your credit report.

If you’re tempted to close the account, however, remember that you’d be giving up that line of available credit. If you carry balances on other cards, closing a credit card may increase your credit utilization rate, which can lead to lower credit scores. For that reason, you’ll typically get more benefit from keeping a paid-off account open, unless the temptation to rack up charges is too high or you’re paying an annual fee that doesn’t work with your budget.

Installment Loans

Installment loans, such as mortgages or auto loans, have a set term with fixed monthly payments. Unlike a revolving credit account, once the borrower makes the final monthly payment, the account is closed. Another contrast to revolving credit is that zeroing out your balance on an installment loan may not have much of a benefit to your credit—in fact, it may actually cause your scores to drop.

For some, paying off a loan won’t affect credit scores much at all. For others, it may cause a temporary drop. This can happen if it was your only installment loan, since having a mix of different types of accounts helps your score, and losing your one installment account can bring it down slightly. Additionally, if it was your only account with a low balance, paying it off can hurt your score if the other active accounts are a long way from being paid off.

Fortunately, any dips are usually temporary. Once the installment loan is paid off, your credit score should go back to where it was within one or two months. If your score doesn’t shoot up after paying off the loan, don’t despair: The paid-off loan will remain on your credit report for up to 10 years after the account closes. If your account was in good standing, having this positive history on your credit file can help your credit score in the long run.

Negative Items

Just as responsible spending and debt repayment can benefit your credit for years to come, negative items on your credit report can hurt your score. Most negative items stay on your credit report for seven years, but others can last a decade. Here’s what to expect:

- Late or missed payments: When a significantly late payment on a loan or line of credit is reported to the credit bureaus, it can stay on your report for up to seven years.

- Collections: Debt that’s past due enough that it’s sent to collections will be noted on your credit report and remain there for seven years. Collection accounts can have a significant negative impact on your score.

- Bankruptcy: Filing for bankruptcy can significantly hurt your credit score, and for a long time. Chapter 13 bankruptcy remains on credit reports for seven years, while Chapter 7 bankruptcy sticks around for 10 years.

- Other negative marks: Credit reporting agencies can also report foreclosures, repossessions and debt settlements for up to seven years since these all indicate that credit wasn’t paid back as agreed.

What Are the Credit Scoring Factors?

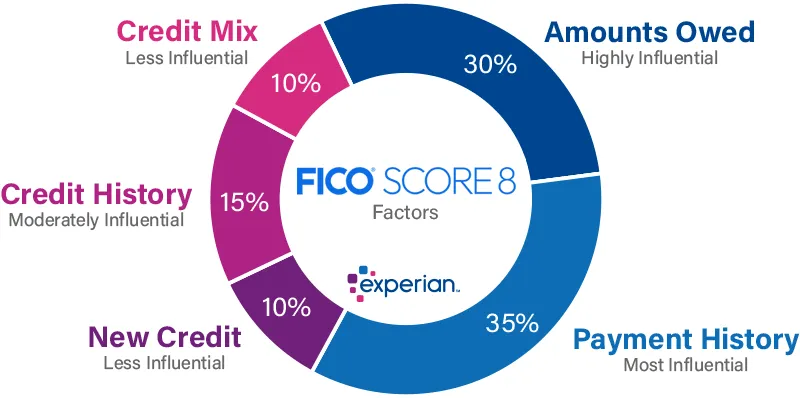

As you pay off and consider closing debt accounts, it’s prudent to understand how your credit score is calculated and how your actions will impact it.

These are the top credit scoring factors to be aware of:

- Payment history: The most important factor, accounting for 35% of your FICO ® Score, reflects whether you pay your bills on time. Missing even one payment can hurt your score; paying bills on time helps it.

- Amounts owed: Accounting for 30% of your FICO ® Score, this factor indicates how much you owe on loans as well as your credit utilization rate on lines of credits. Keeping your utilization rate below 30% can benefit your credit.

- Credit history: The age of your accounts determines 15% of your score. The longer you’ve had credit accounts in good standing, the better, so it could be worthwhile to keep old credit card accounts open even if you don’t use them often.

- Credit mix: The diversity of your credit accounts is less important, accounting for 10% of your score, but it can make a difference. For example, if you’ve only had installment loans (such as student loans or auto loans), opening a credit card account can improve your credit mix. That doesn’t mean you should open a new account solely for this purpose, however.

- New credit: Whenever you apply for a new loan or line of credit, a hard inquiry goes on your credit report and can temporarily lower your score. Approximately 10% of your credit score factors in how many new accounts you’ve recently opened and how many hard inquiries you have, since an increase in those activities can make you look risky to lenders.

If you haven’t reviewed your credit score or report in a while, it’s worth a look to assess how each of these credit score risk factors affect you personally.

The Bottom Line

When you check your credit score once, you can see where you stand currently with each of these factors. That helps, but it’s even more beneficial to monitor your credit, which you can do for free with Experian, to get an ongoing look at how your financial behaviors shape your credit score. If your score needs improvement, remember the factors that impact your credit the most and try to make adjustments accordingly. When you know how your credit score works and you put in the effort to improve it, watching it rise over time will improve your financial wellness and leave you with a sense of gratification.

Instantly raise your FICO ® Score for free

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Start your boost

No credit card required

About the author

Emily Starbuck Gerson

Emily Starbuck Gerson is a freelance writer who specializes in personal finance, small business, LGBTQ and travel topics. She’s been a journalist for over a decade and has worked as a staff writer at CreditCards.com and NerdWallet. Emily’s work has appeared in CNBC, MarketWatch, Business Insider, USA Today, The Christian Science Monitor and the Chicago Tribute, among other websites and publications.

Explore more topics

Share article

Experian is a globally recognized financial leader, committed to being a Big Financial Friend—empowering millions to take control of their finances through expert guidance and innovative tools. As a trusted platform for money management, credit education, and identity protection, our mission is to bring Financial Power to All™.

- Security freeze

- Fraud alert

- Disputes

- Denied credit

- Identity theft victim assistance

- Active duty military

- Opt out of prescreen offers

- Upload a document to Experian

- Credit report & scores

- Fraud & identity theft

- Banking

- Credit cards

- Loans

- Insurance

- Mortgage

- Investing

- Personal finance

- News & research

- Free credit monitoring

- 3-bureau reports & FICO ® Scores

- Check credit

- Improve credit

- Establish credit

- Experian CreditLock

- Annual credit report

- Legal terms & conditions

- Privacy center

- U.S. data privacy policy

- Press

- Ad choices

- Careers

- Investor relations

- Contact us

To view important disclosures about the Experian Smart Money™ Digital Checking Account & Debit Card, visit experian.com/legal.

The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Θ Credit score calculated based on FICO ® Score 8 model. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author’s alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities, unless sponsorship is explicitly indicated. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies (“our partners”) from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

*For complete information, see the offer terms and conditions on the issuer or partner’s website. Once you click apply you will be directed to the issuer or partner’s website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms – and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

© 2025 Experian. All rights reserved.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

https://www.experian.com/blogs/ask-experian/how-long-after-you-pay-off-debt-does-your-credit-improve/